iBOMMA: A Detailed Article

iBOMMA: A Detailed Article

Anime Girlies: Unveiling the Kawaii World of Animated Characters

25 photos of Anime Girlies

Popular Stories

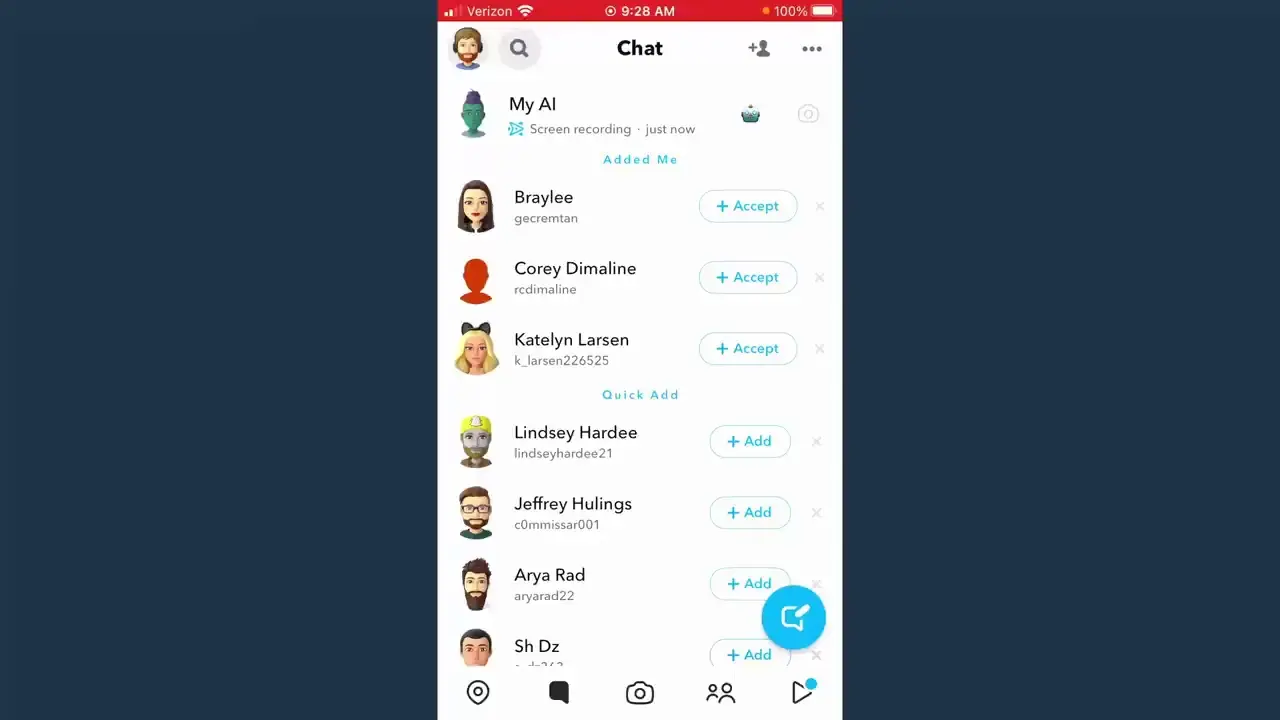

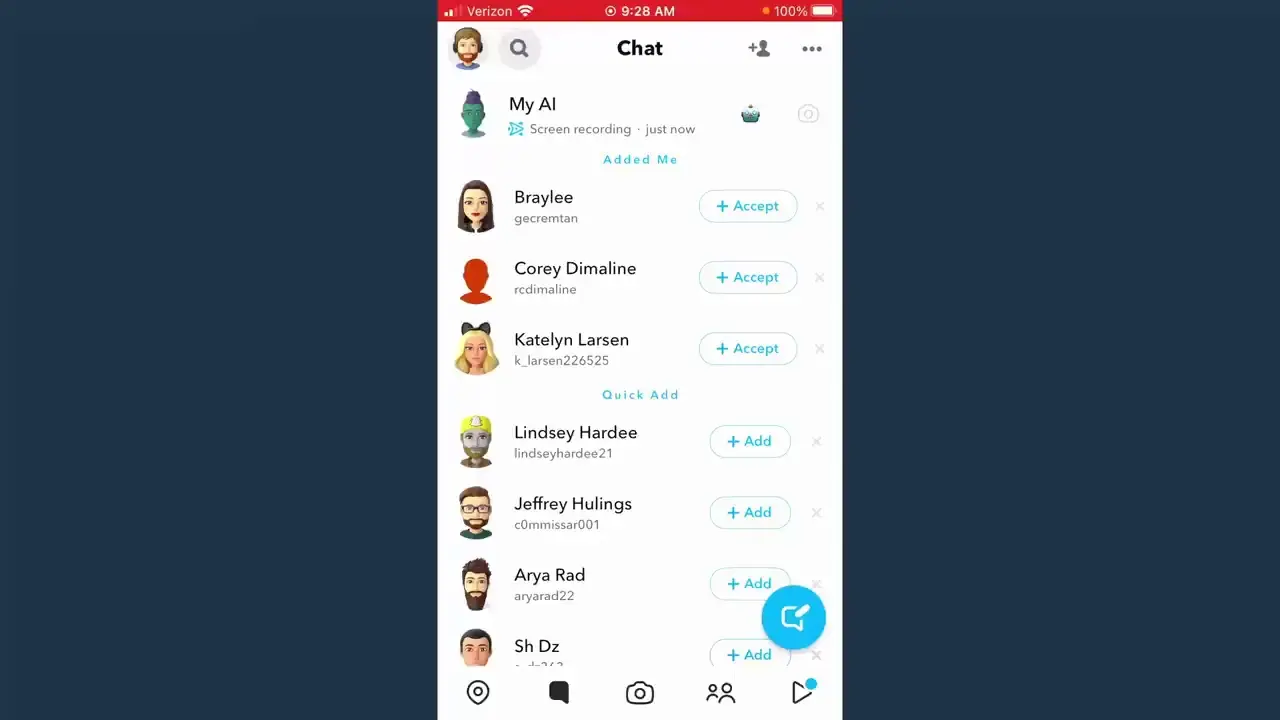

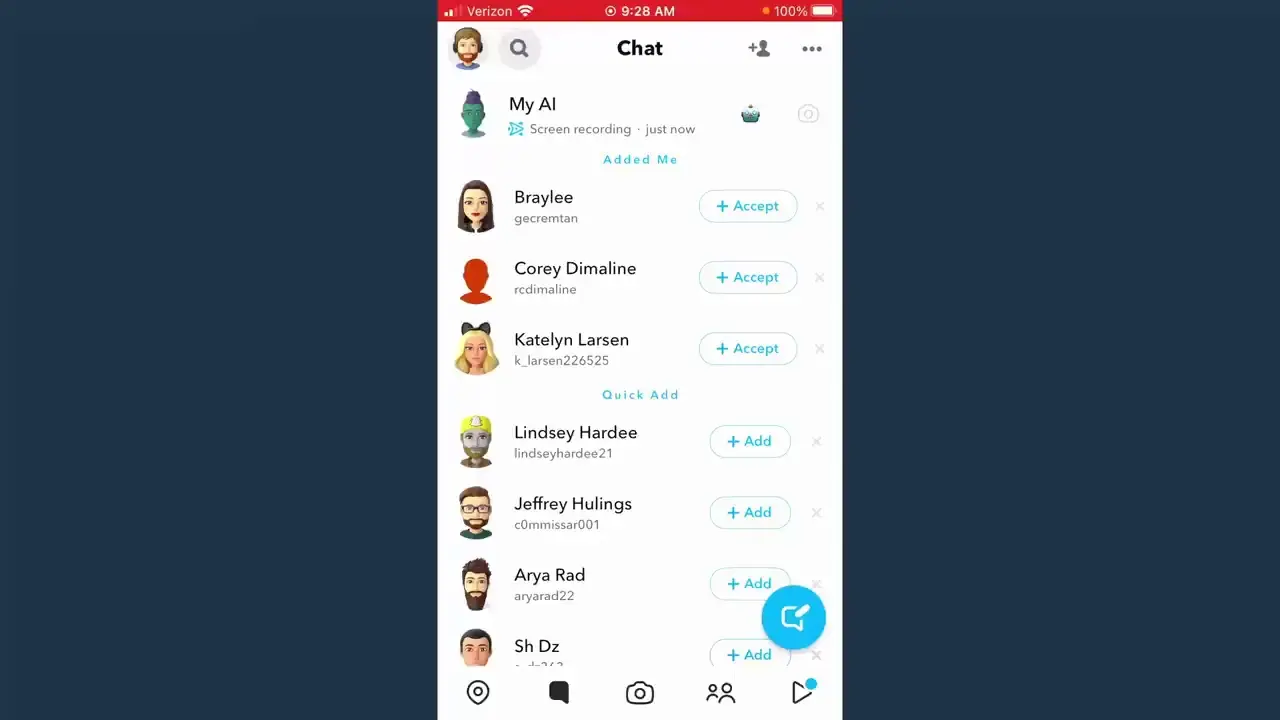

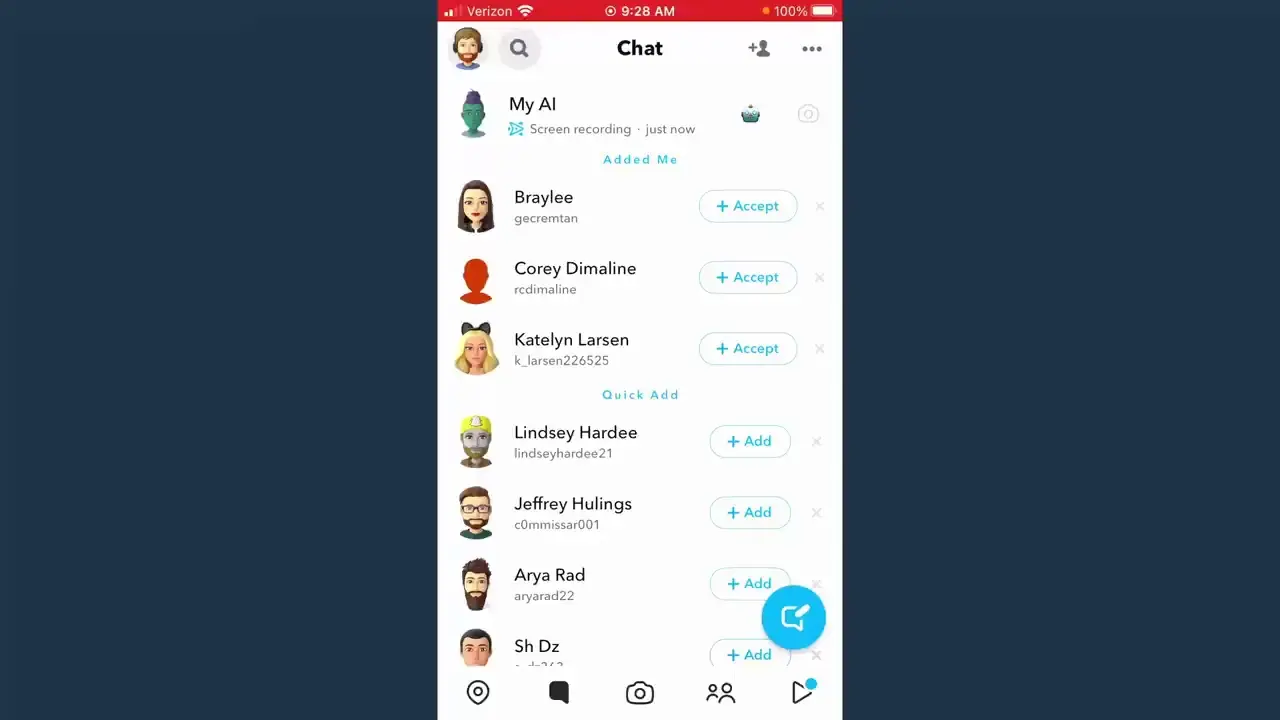

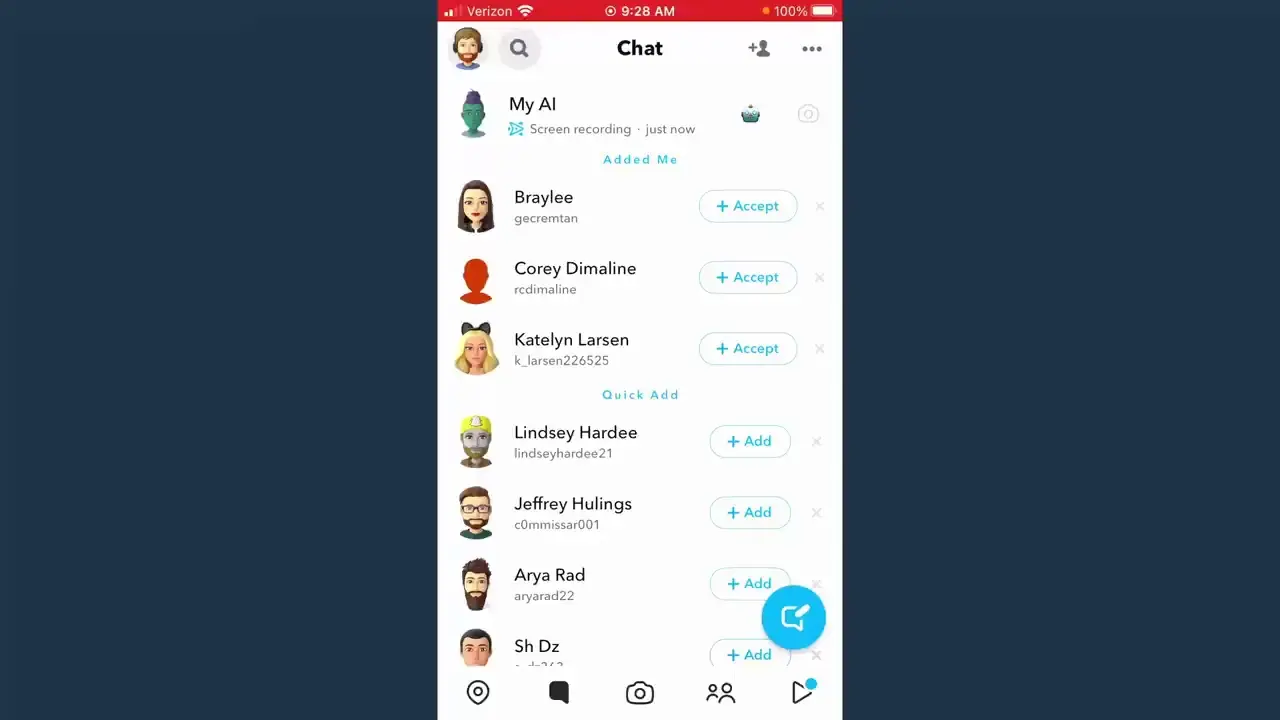

How to Remove ‘My AI’ from Snapchat

How to Delete My AI in Snapchat “Snapchat’s My AI Chatbot: A Convenient Tool with Privacy Considerations Snapchat’s My AI chatbot, initially exclusive to Snapchat+

Anime Girlies: Unveiling the Kawaii World of Animated Characters

25 photos of Anime Girlies

All About

Photography

How to Remove ‘My AI’ from Snapchat

iBOMMA: A Detailed Article

Travel & Explore the world

How to Remove ‘My AI’ from Snapchat

How to Delete My AI in Snapchat “Snapchat’s My AI Chatbot: A Convenient Tool with Privacy Considerations Snapchat’s My AI chatbot, initially exclusive to Snapchat+

Anime Girlies: Unveiling the Kawaii World of Animated Characters

25 photos of Anime Girlies

10 Best Shopify Apps For Your Ecommerce

Struggling to pick the perfect Shopify apps for your ecommerce store? Look no further! This snippet explores 10 powerful apps to boost sales (Klaviyo, Yotpo),

Matthew Patel: More Than Just an Evil Ex

The name Matthew Patel might conjure up images of a flamboyant skateboarder with a killer haircut and a fierce competitive streak. But to simply label

What is Gap Insurance?

Understanding Gap Insurance: Bridging the Financial Divide In the complex landscape of auto insurance, one term that often surfaces is “Gap Insurance.” But what exactly

Explore and travel the world

How to Fix Error Code: m7111-1331-5059

Iman Gadzhi Age, Boyfriend, Height, Bio, NetWorth, Wiki

11 Best Microsoft Word Alternatives

201+ Best Pluto TV Channels List (Free & Paid) in April 2024

10 Best Banks For Education Loan In United States of America

Beauty Tips and Tricks

How to Remove ‘My AI’ from Snapchat

How to Delete My AI in Snapchat “Snapchat’s My AI Chatbot: A Convenient Tool with Privacy Considerations Snapchat’s My AI chatbot, initially exclusive to Snapchat+

iBOMMA: A Detailed Article

iBOMMA: A Detailed Article

Anime Girlies: Unveiling the Kawaii World of Animated Characters

25 photos of Anime Girlies

Glorious Fashion

What is Invideo

InVideo is a cloud-based video editing platform that enables users to create professional-looking videos without any prior experience. It offers a wide range of features,

10 Best Platforms to Hire Professional Designers

Need a logo, website, or video? This summary lists top platforms to hire creative freelancers (Bunny Studio, Fiverr, Upwork) or run design contests (99designs, DesignCrowd).

Dina Kalanta Age, Boyfriend, Height, Bio, Net Worth, Wiki

Dina Kalanta Age Networth 2023 It is estimated that Dina Kalanta has a net worth of around $4 Million. You will be able to get accurate information about Dina

Food & Drinks From Around the World

Watch Animag's Video Channel