Skip to content

Watch, Read, Listen

- 20 Easy Methods for Reducing Stress: A Roadmap to Inner Peace

by Nikhil Satish Pawar

- Understanding the Movie “Waves”

by Nikhil Satish Pawar

- Love What You Have, Before Life Teaches You to Love — Tymoff

by Nikhil Satish Pawar

- 100 quotes that change your life with Photos

by Nikhil Satish Pawar

- The 10 Best ‘Oppenheimer’ Movie Quotes

by Nikhil Satish Pawar

- 10 phrases to use when your toddler doesn ‘t listen

by Nikhil Satish Pawar

- If you use these 10 phrases regularly, you have very high level of emotional intelligence

by Nikhil Satish Pawar

- 10 Signs Your Partner Loves You Unconditionally: A Psychologist’s Guide

by Nikhil Satish Pawar

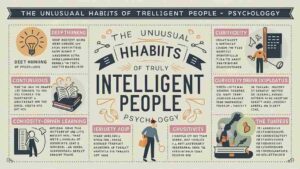

- 10 Unusual habits of truly intelligent people, according to psychology

by Nikhil Satish Pawar

- How to Be a Good Friend

by Nikhil Satish Pawar

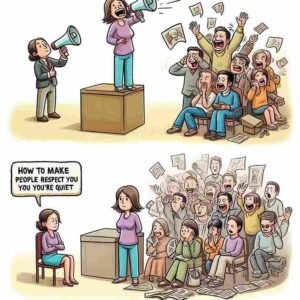

- How To Make People Respect You If You’re Quiet

by Nikhil Satish Pawar

- Can a long distance relationship work?

by Nikhil Satish Pawar