[ad_1]

The city is divided into 18 zones for tax assessment and collection. Out of 148 groups, 140 groups comprising 847,487 properties have been assigned UPIC numbers. The remaining 8 groups are currently in progress. Presently, there are 635,000 registered properties, of which 577,784 have been geotagged. Numbering for 60,000 old and new properties is still pending. Among the unregistered but numbered properties, 254,000 have been identified. Thus, the city currently has 847,487 properties. Out of these, 503,041 properties have been internally measured.

Three Phases of Tax Assessment:

The municipality has appointed a consulting agency for the property survey. This agency is conducting the survey using advanced drones, categorizing properties as new, extended, or changed in use. The tax assessment of these properties will be carried out in three phases. The first phase involves bringing newly identified properties under the tax net. The second phase will assess properties with usage changes or extended construction. The third phase will update previously assessed properties without imposing any additional taxes. Only those 635,000 property owners whose usage has not changed will have their information updated without receiving any notice.

57,000 Properties Receive First Tax Collection Notice; 140 Crores Expected for the Municipal Corporation:

The ongoing survey has identified 254,000 new properties. Out of these, about 57,000 property owners are undergoing the process of hearing complaints and suggestions. These property owners are being issued the first tax notice, with distribution underway. The municipality expects to collect 140 crores, with 55 crores as current demand and 85 crores as arrears.

3 Crores Deposited into Municipal Treasury Upon Receiving Notices:

Out of the newly identified properties, 14,500 have had their bills prepared. The total amount expected from these properties is 30.84 crores, of which 3 crores have already been deposited into the municipal treasury via QR code.

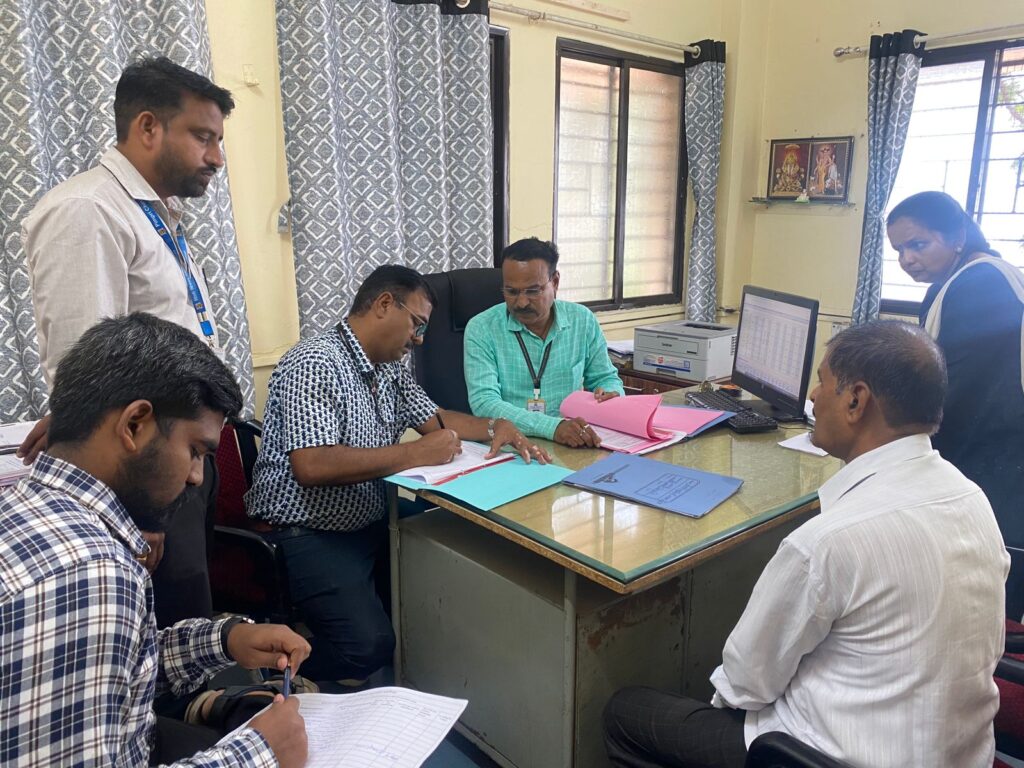

Seven Hearing Centers Set Up:

For newly identified, extended construction, and changed use properties, seven key hearing centers have been established in the city. Detailed hearings are being conducted for factors affecting taxable value, such as area differences and usage changes. Additionally, all issues such as updating index-II, correcting names, and updating mobile numbers and email IDs are being resolved promptly at these centers, without the need for repeated visits. The consulting agency has made its entire system available at the seven centers, where minor taxpayer issues are being resolved ‘on the spot.’

Survey Progress in 8 Groups:

The city’s tax assessment and collection department has divided the area into 148 groups. Of these, 140 groups have been assigned UPIC numbers, but challenges have arisen in 8 groups, including red zones and slum areas. Efforts are ongoing to educate slum dwellers on the importance of UPIC IDs, explaining future benefits to encourage them to register.

Pimpri Chinchwad Municipal Commissioner Shekhar Singh:

“While the municipal corporation is becoming technology-friendly, the tax collection department is implementing various new technologies. We have successfully reached every taxpayer in the last two years through data analysis, effective publicity, and the accurate use of social media. The next critical step was the comprehensive property survey using satellite images and drone surveys, where we are also seeing success. With active support from citizens, we have been able to complete such an extensive initiative in a short time. We are pleased that we can increase municipal revenue without imposing any additional tax burden on citizens.”

Additional Commissioner Pradeep Jambhale-Patil said, “Collecting long-pending dues over the past two years was a major challenge. However, by using various technological methods, including seizure and auction processes, we have had considerable success in collecting arrears. I have consistently reviewed the monthly work of officers and staff and provided timely guidance over the past two years. Although tax collection revenue has doubled over this period, it was necessary to increase current demand. The comprehensive property survey has been extremely beneficial in this regard.”

Assistant Commissioner Nilesh Deshmukh:

“After taking charge of the tax collection department, restructuring the department was a significant challenge. We provided the necessary training and facilities to officers and employees, along with adopting evolving technologies. The valuable guidance of the honorable commissioner and additional commissioner has been instrumental. The strong support of the honorable commissioner during many critical moments has been personally invaluable to me. The daily review of this comprehensive property survey initiative ensures that increased revenue is maintained and continues to grow.”

[ad_2]